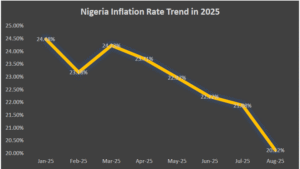

Nigeria Inflation Summary – 2025 This report provides a synthesised overview of Nigeria’s inflationary dynamics in 2025, highlighting key trends, comparisons with peer countries, policy responses, and risks. It draws from recent official statistics and macroeconomic analyses published through September 2025. Nigeria: 2025 Inflation Dynamics At the start of 2025, Nigeria’s headline inflation (year-on-year) was reset to approximately 24.48% following CPI rebasing and reweighting. Over the course of the year, inflation has shown a clear downward trajectory: – January 2025: ~24.48% – February 2025: ~23.18% – March 2025: ~24.23% – May 2025: ~22.97% – June 2025: ~22.22% – July 2025: ~21.88% – August 2025: ~20.12% The decline from July to August (~1.76 percentage points) represents one of the steepest monthly drops recorded. As of August 2025, Nigeria has recorded five consecutive months of disinflation. Additional indicators reinforce this trend. Food inflation stood at ~21.87% in August 2025, while core inflation (excluding food and volatile items) was ~20.33% year-on-year. Month-to-month inflation growth has slowed significantly, with August recording ~0.74%, compared to nearly 2% in July. In response to these improvements, the Central Bank of Nigeria (CBN) cut its benchmark policy rate by 50 basis points in September 2025, bringing it to 27.00%. This marks the first rate cut since 2020, justified by the disinflationary momentum observed.

Fig. 1: Nigeria Inflation Rate Trend from January – August 2025

Comparison with Peer Economies Nigeria’s inflation remains elevated relative to many African peers, despite recent improvements. Ghana (July 2025): ~12.10% inflation, reflecting significant progress in stabilisation efforts. – South Africa (August 2025): ~3.30%, among the lowest on the continent. These comparisons highlight Nigeria’s structural inflationary challenges. While many African economies are recording single-digit or low-double- digit inflation, Nigeria’s levels remain in the 20%+ range, underscoring the need for sustained reforms and macroeconomic stability. Outlook and Risks Looking ahead, if the disinflation trend continues, Nigeria could close 2025 with inflation in the high teens (approximately 17–18%). However, this trajectory is subject to several risks, including: – Food supply disruptions (poor harvests, logistics challenges) – Exchange rate volatility and external cost pressures – Energy, fuel, and utility price adjustments – Inflation expectation management The CBN’s cautious optimism, reflected in its September rate cut, will require vigilant monitoring to ensure that gains are consolidated and inflation expectations remain anchored. References Nairametrics (2025). Nigeria’s headline inflation eases to 20.12% in August 2025. National Bureau of Statistics (2025). CPI Inflation Reports. https://microdata.nigerianstat.gov.ng/index.php/catalog/154/download/1254/CPI_June_2025_Repo rt.pdf